May 20, 2023

Pre-Summer Check-In on The Big Questions for 2023

Ahead of the traditional Memorial Day start to summer, we check in on the Five Big Questions for 2023 we highlighted in our New Years Day post (here). Our focus at the start of 2023 was on:

- Underlying ROCE trends

- Business model questions (primarily for upstream companies)

- The need for most (upstream) companies to add projects/assets/inventory

- Confidence in the long-term demand outlook for oil and gas

- The viability and willingness of Euro financials to continue supporting traditional energy

Thematically, we see encouraging signs about ROCE trends taking into account the pullback in oil prices from 2Q2022 highs. Our call for a need to add duration (i.e., extend inventory and asset life) is clearly front and center, though investors have not yet embraced the diversified upstream business model. We believe a wide swath of energy observers have yet to accept our more optimistic view that traditional forms of energy, including crude oil, natural gas, and coal, are all likely to grow for the foreseeable future. Finally, we believe our concerns that European financial firms would be steadily exiting financing and insuring the traditional energy sector is, unfortunately, coming true, perhaps even at a faster pace than what we were contemplating just a few months ago.

The major questions for the remainder of the year have not changed much. Yes, the downside risks of a Super Vol macro backdrop have grown due to the US regional banking crisis and other signs of economic slowdown. That said, if underlying ROCE trends remain favorable, we believe the recognition that trough ROCE will be significantly better today than what was seen in 2020 or even 2015-2016 is a catalyst to a re-rating higher for either individual companies or the broader sector that demonstrates improved trough ROCE.

Corporate and investor recognition that the return of risk taking is needed has not yet resulted in clarity about what "good" investment looks like or whether diversification or remaining a shale pure-play is preferred. It is clear that sustainability of shareholder distributions is dependent on having a sizable (we prefer "decadal") inventory of low cost of supply projects.

Progress update on our Five Big Questions for 2023

(1) If oil prices and ROCE fall in 2023, does it mean the structural ROCE upcycle is over?

January 2023 view: No, so long as ROCE vs oil prices stays "above the regression line."

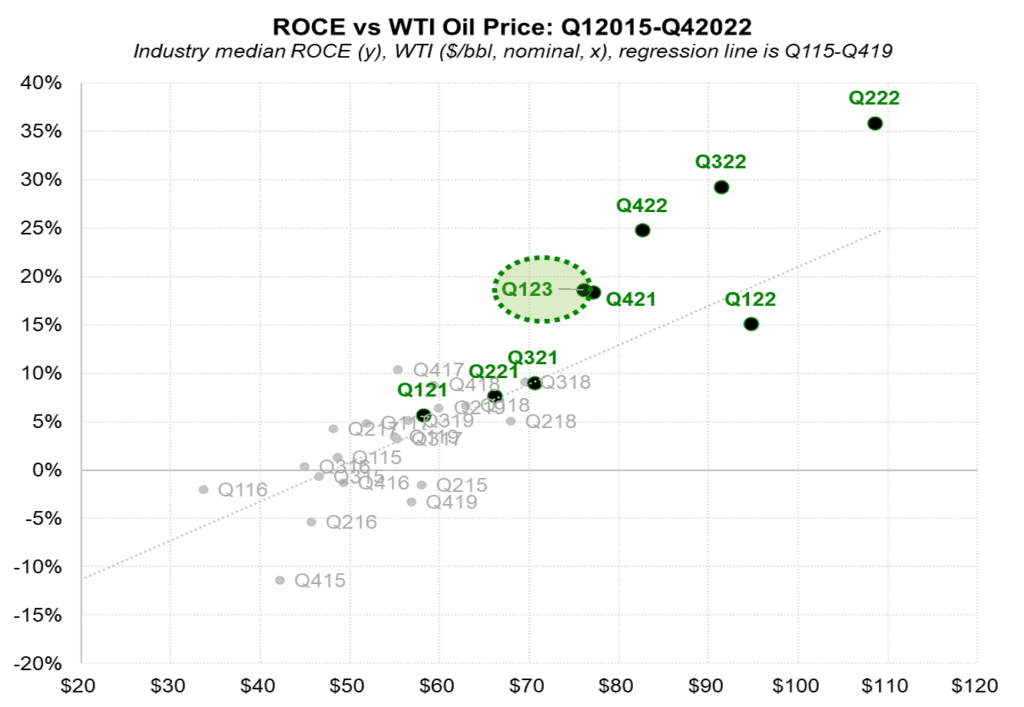

May 2023 update: So far, so good. We have two more quarters under our belt since the New Years Day post, with both 4Q2022 and 1Q2023 results remaining healthy after adjusting for the level of oil prices (Exhibit 1).

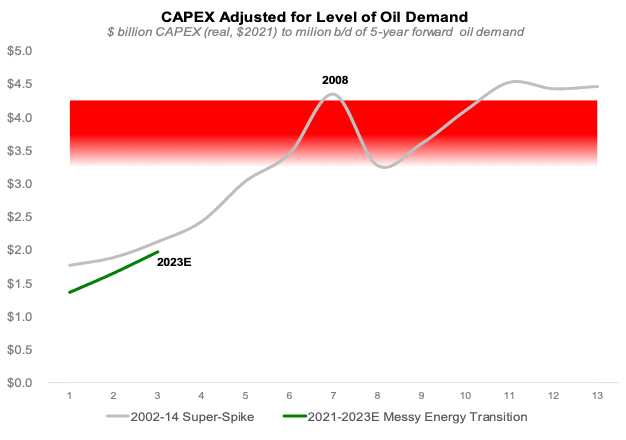

The fact that CAPEX remains well below previous "danger zone" levels we believe is a key reason investors can have confidence that profitability will remain healthy (Exhibit 2). The conundrum is that capital discipline does not mean never taking a risk or spending on anything ever again. If a core objective for any publicly traded company is to outperform the S&P 500 over rolling 5, 10, and 20 year periods, there will be a need to take risk.

Exhibit 1: ROCE trends remain favorable after adjusting for oil price level

Source: Bloomberg, S&P CapitalIQ, Super-Spiked.

Exhibit 2: CAPEX remains well below “danger zone” levels

Source: S&P CapitalIQ, Super-Spiked

(2) In a world that favors ROCE and dividends, is a diversified E&P business model preferable to being a pure play?

January 2023 view: Yes, in many cases.

May 2023 update: Our answer remains that the days of the pure-play US shale model being the only game in town is behind us. That said, investors have not yet definitively embraced diversified business models for the upstream sector. We would also remind readers that the point is not that every pure-play needs to diversify, at least not immediately.

That said, it has been at least a decade of shale being the overwhelming focus area for much of the publicly traded industry. The ability to invest offshore or overseas is diminished for many if not most. This presents a competitive advantage opportunity for those that have retained organizational skill.

(3) How can an E&P company add duration and diversify without upsetting investors in the short term?

January 2023 view: It's tricky, case specific, and may not be possible...i.e., it may not be possible to not upset investors.

May 2023 update: We have not seen much by way of companies engaging in diversifying transactions, so the jury is still out on this. That said, investors still seem to very much be in the mode of "don't you dare try to crank up CAPEX." We appreciate the reasons for this perspective (terrible sector profitability last decade). It will be up to companies to be brave when exceptional opportunities arise and to demonstrate the merits of whatever risk is being taken. Moreover, there is plenty of risk in standing still and being left behind when the world changes.

(4) What does $TSLA's valuation correction mean for EV growth projections?

January 2023 view: There will be growing recognition in 2023 that a 100% EV future is a pipe dream, no matter how many decades in the future one looks.

May 2023 update: While Tesla shares have rebounded from year-end 2022 lows, the question still holds. We believe there is at least a budding recognition that the hockey stick EV adoption forecasts are hardly a sure thing due to a host of issues related to affordability, raw materials challenges, timing of building out infrastructure, etc. That said, we believe the broad consensus still believes crude oil demand will peak or at minimum plateau within the 2020s.

The key drivers of our view that oil demand is unlikely to peak this decade is: (1) massive over-estimation by most major forecasters of improved fuel economy gains, which have historically disappointed government-driven headline mandates by 75%-95% (excluding Europe and Japan which have done better); (2) challenges with raw materials, infrastructure, and affordability of EVs (we expect considerable growth in EV sales, just not the hockey stick to near 100% global uptake within the 2030s); and (3) the massive unmet energy needs of the other 7 billion people that do not live in Western Europe, the United States, Canada, or Japan (discussed here).

(5) Does the ongoing retreat of European financials from traditional energy matter?

January 2023 view: Yes in the short term. No in the long run.

May 2023 update: Momentum is building for the whole-sale exit of the European financials and insurance sector from financing traditional oil and gas in coming years. To be sure, it is not impossible for the trend to some day be reversed. But year-to-date it has been a one-way street of a growing number of primarily European (including UK) firms declaring they would no longer finance or insure new oil and gas projects. If anything, the trend is happening faster than what we expected in January.

Whereas our answer was "yes in the short term, no in the long term" previously, we would now say "yes" over both time frames. The reason we had previously said "no" for the long term was the idea that European financial institutions could be replaced with alternatives. That may be true, but is pretty ill-defined at this time. It seems unlikely, for example, that Indian or Chinese banks will be global banking and insurance players within this decade, if ever. So where will future capital and insurance come from? Now is the time for the oil and gas industry individually and collectively to get its act together, while it is still in a position of relative strength.

Macro volatility, regional banking crisis, and improved trough ROCE

In our view, a major silver lining of the recent bout of macro softness would be investor recognition that trough profitability is much improved versus the 2020 or 2015-2016 trough periods. To be clear, we are not suggesting that circa $70-$75/bbl WTI is a trough oil price. It is quite possible in a more meaningful recession scenario that lower oil prices materialize.

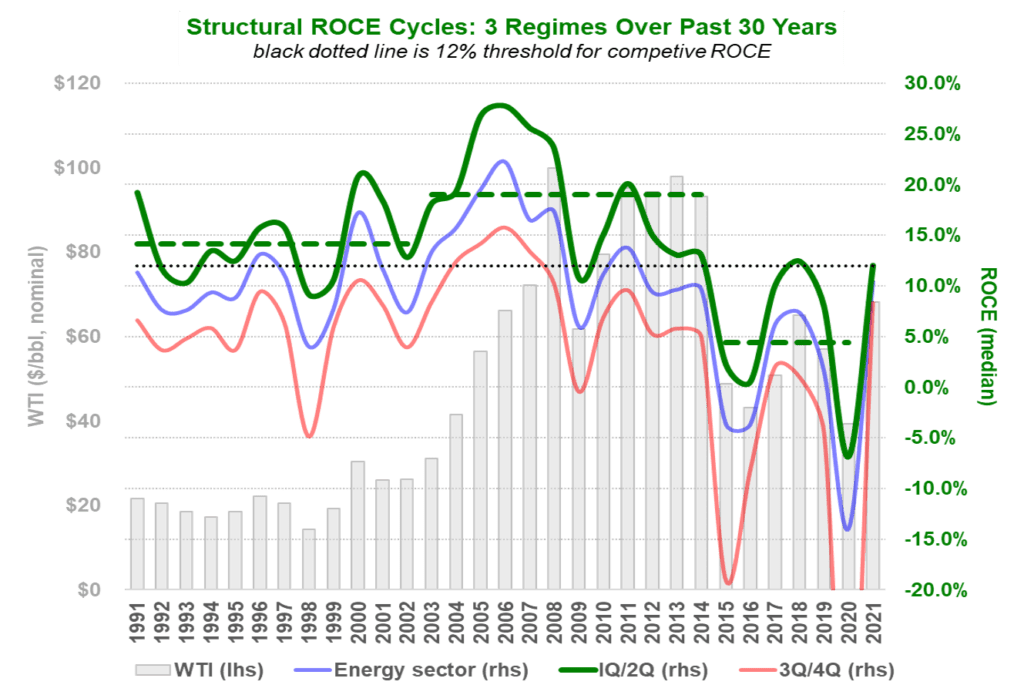

The key items we are watching are for individual companies and the sector broadly to: (1) not lose money in a deep trough and (2) generate at least an 8%-10% "cost of capital" ROCE in a more normal trough environment. In the context of the long-term structural cycles, there will be many mini-cycles along the way. We observe that top quartile companies have historically demonstrated superior trough of cycle profitability as shown in Exhibit 3.

In the event more meaningful global economic weakness materialized over the next year that contributed to a further weakening of oil prices, we would look for confidence that trough profitability had materially improved as being a key catalyst to improved valuations ONCE the broader macro began to recover.

Exhibit 3: Top ROCE quartile companies are typically profitable at sector troughs

Source: S&P CapitalIQ, Super-Spiked.

🎤 Streams of the Week

Please click on the link to see my appearance on the Wicked Energy with JG podcast originally recorded about six weeks ago and published this past week. There was a technical issue with the first few minutes so we start mid-discussion talking about the then upcoming MLB season (again, this was recorded before the season started) before transitioning to un-retirement, mental health and work-life balance, and ultimately major Super-Spiked themes.

⚡️On a Personal Note: Memorial Day

Super-Spiked is not published over Memorial Day weekend. If we are being truthful, it is because Memorial Day weekend is the traditional summer kick off in the United States and our local club hosts its major golf tournament for members on Friday and Saturday. Last year, my partner and I won our flight, but were eliminated in the first round of the shootout. A former Goldman colleague (some of you know my friend “Strat”) now at Jefferies and his partner took home the title while initiating a new pond jump tradition. I would also add that taking time off is important to ensuring research does not devolve into forced maintenance or "greatest hits" mode.

At Veriten, we have not forgotten that the Memorial Day holiday was created to honor and mourn US military personnel that gave their life in service of our country. Everyone at Veriten is grateful for their sacrifice. We do not take our freedoms for granted.

See you in two Saturdays.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

Based on this, you might like:

May 6, 2023

Transitioning The Transition To a Rest of World Focus

This week we provide a video update on our view about the need for “energy transition” as a concept to itself transition to one that is focused on meeting the energy supply needs of the 7 billion people that live outside of the United States, Canada, Europe, and Japan.

Play now