April 6, 2024

Spring Check-In On Growth And Returns

This week we check-in on what in essence are the ultimate drivers of any sector: growth and returns. In our view, traditional energy valuations reflect skepticism on the sustainability of both metrics. Investors have been concerned that “peak oil demand” could be on the horizon (i.e., within a decade or less) driven by a mixture of product substitution and efficiency gains, and that recently improved profitability will prove transient. As veteran Super-Spiked subscribers surely know, we have the opposite view. “Obliterating peak oil demand” (here) summarizes our stance that we do not believe anyone today can possibly know the decade, let alone year, when oil demand will peak. As for profitability, with 4Q2023 earnings season now in the rearview mirror, we can confirm that 2023 marked year three of what we expect to be a 10-15 year era of structurally improved profitability for the traditional energy sector.

We have spent considerable time discussing the massive unmet energy needs of the other 7 billion people on Earth that are in various stages of moving up the economic and hence energy demand “s-curve.” We have spent far less time talking about demand trends for The Lucky 1 Billion of Us, since we largely agreed with oil demand bears about maturity and the potential for demand erosion, even if our pace of expected declines was less than what other forecasters expected. Remarkably, OECD demand in 2024, at least thus far, has been holding up better than even we thought. If that trend continues, expect the peak oil demand crowd to continue to move to the right the peak year being forecast. We also highlight a recent report from Goldman Sachs Research’s Autos equity analyst team that suggests the electric vehicle (EV) adoption curve could be closer to their bear-case scenario through 2030. Finally, there is mounting evidence that Tesla shares have seen their best days, at least for the foreseeable future, which is yet another indicator that hype around EVs is deflating to more realistic growth scenarios.

On profitability, we show our usual quarterly look at return on capital employed (ROCE) versus oil prices, balance sheet health, and capital spending (CAPEX) data now that 2023 is in the past. We also introduce the resurrection of a “cash-on-cash” return metric that was pioneered by the legendary energy analyst team at Credit Suisse First Boston in the 1990s, a version of which we used at Goldman Sachs in the 2000s. As we have discussed, there are some downsides to the ROCE calculation related to write-offs and M&A analysis; expanding our analytical toolkit to include what we called “CROCI” (cash return on gross cash invested) we think will be helpful as we analyze the sector.

GROWTH: Obliterating peak oil demand

Resilient OECD oil demand?

It remains our view that it is not possible to predict the decade let alone year when oil demand will peak due to the significant unmet energy needs of the other 7 billion people on Earth (see previous posts here and here). However, within that framework, we largely shared the consensus view that OECD demand was quite mature and could slowly erode in coming years, even as our OECD forward demand estimates have been higher than those forecasting an imminent global oil demand peak. If in fact OECD demand is hanging in better than most expected, there is essentially no chance global oil demand will be peaking any time soon. We would expect those calling for a global oil demand peak in the 2028-2030 time frame to push those forecasts to the right.

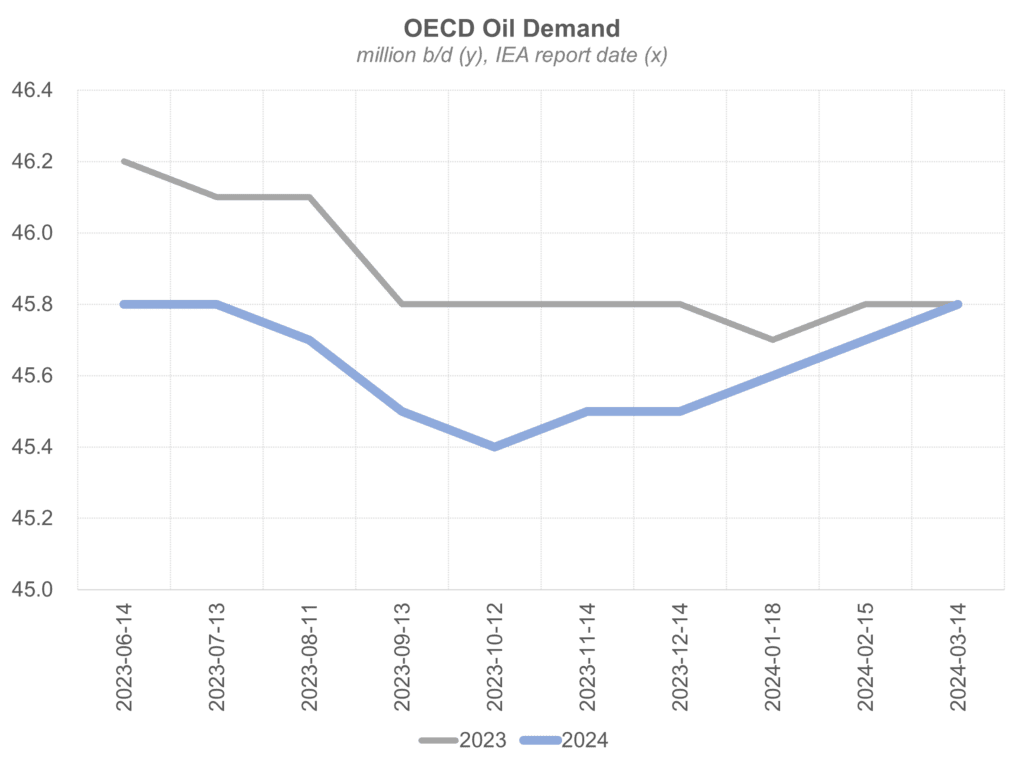

Exhibit 1 shows the trend in International Energy Agency (IEA) estimates for 2024 OECD oil demand. Its initial forecast called for a 0.4 million b/d decline in 2024 versus 2023 despite non-recessionary GDP expectations. Three months into 2024 and the IEA is now forecasting flat OECD demand versus 2023, a figure that would imply we are not seeing an acceleration in efficiency gains this year. We also suspect the impact of historic EV sales has been over-stated in demand estimates by those with more bearish oil demand outlooks.

To be sure, short-term data can be noisy and subject to meaningful revision (of course recent revision trends have been one directional to the upside). It is somewhat ironic given all the focus on the developing world (including by us!), but a lack of OECD demand declines may well be the canary in the coal mine signaling “peak oil demand” is nowhere in sight.

Exhibit 1: The IEA no longer expects OECD oil demand to fall in 2024

Source: IEA, Veriten.

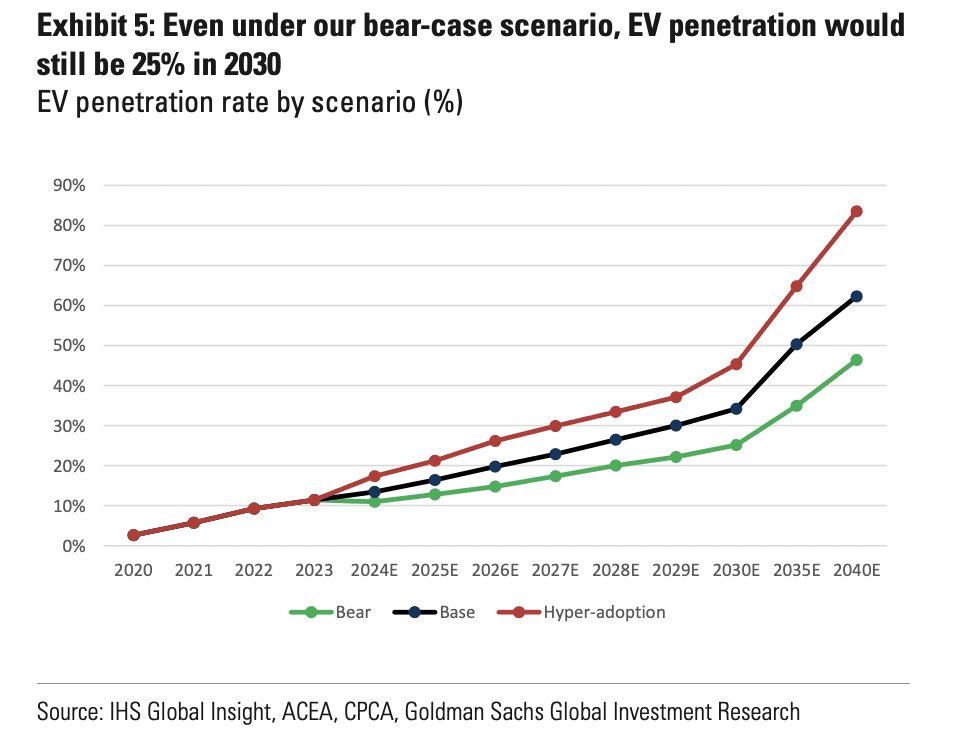

EV adoption s-curves being revised down

Recent EV sales growing pains are well known by market participants and industry observers. Still, we took notice of a recent report from Goldman Sachs Research where its Autos equity research team stated that their bear-case EV penetration forecast for 2024 looked to be more realistic and also highlighted its 2030 estimate using their bear case scenario (Exhibit 2). Presumably the Goldman team still sees a possibility of EV sales eventually reverting to its current base case forecast in future years or it would have officially made a full downgrade of its views. If its bear-case were to become its base-case long-term, EV sales would remain below the important 50% threshold of total auto sales through 2040 (the last year shown in the report).

Exhibit 2: GS highlights its bear-case EV penetration forecasts

Source: Goldman Sachs Research.

As a reminder, passenger EVs impact about 25% of the oil demand barrel. Given absolute growth in the total addressable market for energy as the developing world moves up economic “s-curves” in GDP and hence energy demand per capita, it has been our view that EVs can take a meaningful bite out of how large oil demand could ultimately grow. This is a very different perspective than the idea that EV growth will subtract from current oil demand.

The Goldman research team like others have also noted the acceleration in hybrid vehicle sales, an area that bears watching. In our view, hybrids could be the key to the long-forecast-but-never-achieved acceleration in fuel economy gains.

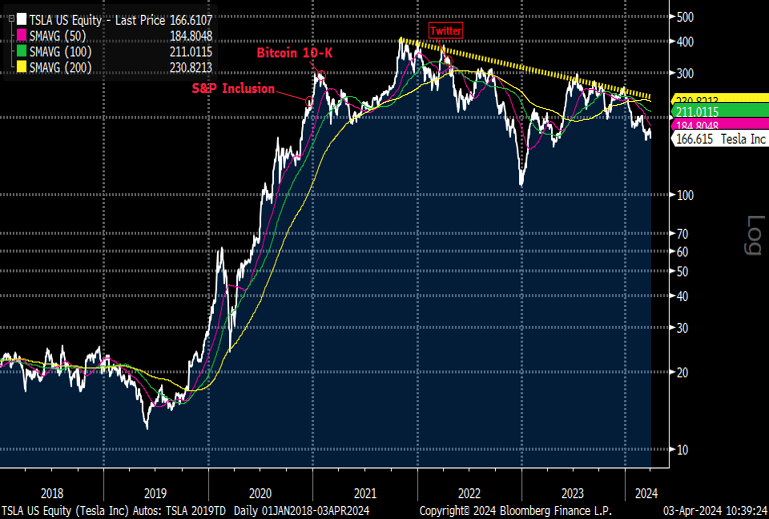

Peak $TSLA

Disappointing 4Q2023 deliveries from EV market-leader Tesla has put further pressure on its share price. While policy is often cited as a reason for legacy auto OEMs (original equipment manufacturers) aggressive push into EVs in recent years, we suspect Tesla’s rocket ship stock price performance also played a role. With Tesla shares looking like they are well past peak, we expect legacy auto companies to continue to scale back how quickly they plan to move to EVs.

Exhibit 3: $TSLA shares appear to be past peak

Source: Bloomberg.

RETURNS: Profitability super-cycle intact

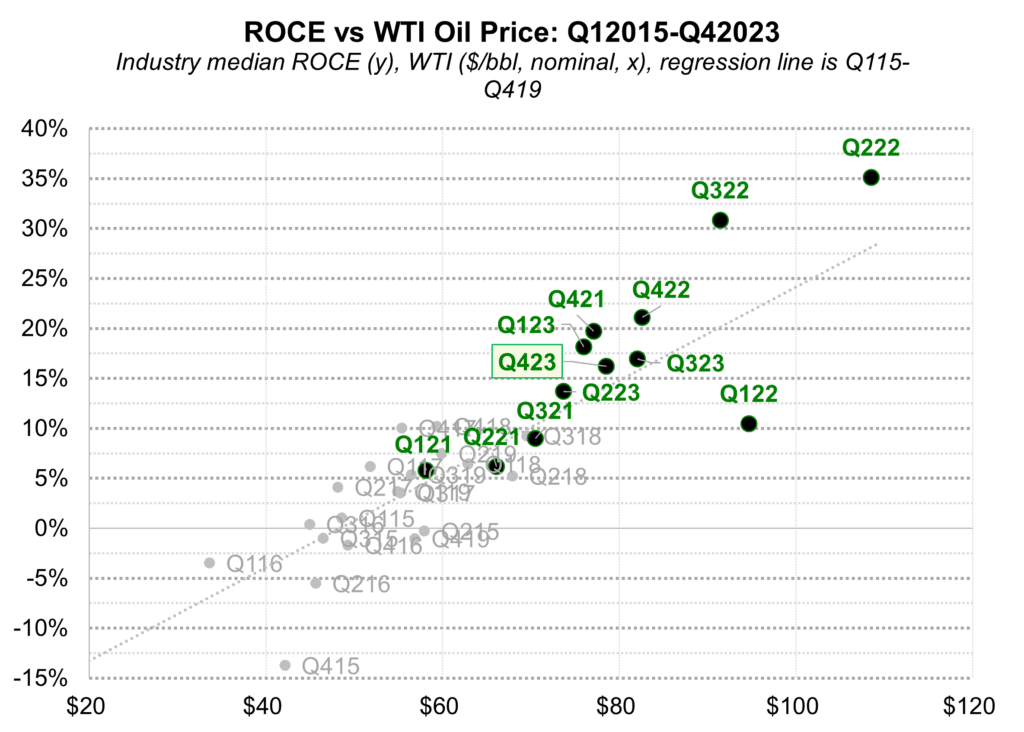

2023 marked year three of the new profitability super-cycle for traditional energy

Exhibits 4-6 show our now standard analysis of sector ROCE relative to oil prices, balance sheet health, and where we are in the CAPEX cycle. In a nutshell, 2023 is now the third straight year of structurally better profitability, sector-wide net debt remains at much improved levels even as it has ticked up in recent quarters, and CAPEX remains closer to trough than anywhere near “danger zone” levels. We remain confident in our view that we just completed year three of what we expect to be 10-15 years of structurally improved profitability.

Exhibit 4: ROCE vs WTI oil prices remains healthy

Source: Bloomberg, FactSet, Veriten.

Exhibit 5: Net debt is no longer falling but remains at much improved levels

Source: FactSet, Veriten.

Exhibit 6: CAPEX in 2023 remained closer to trough and well below “danger zone” levels

Source: FactSet, Veriten.

No single return metric is a panacea

We have generally considered ROCE as our preferred corporate-level profitability metric. Throughout our career we have emphasized the importance of a metric like ROCE to ensure project-level returns translated to adequate corporate-level profitability. This should shock no one, but there is often a remarkably wide gap between company-stated project returns and corporate profitability. That said, we do not consider any single metric to be the equivalent of a religious cause. All metrics have pros and cons and need to be considered as part of a broader mosaic. In previous posts, we have identified the following issues with ROCE:

- Write-offs reward offending companies in go-forward calculations.

- ROCE tends to reward companies that minimize capital spending; while we would never argue for aggressive CAPEX, some amount of spending is required to invest in new opportunities and perpetuate earnings and cash flows.

- We do not agree with the use of the purchase accounting method for the stock component of M&A transactions (we recognize there is a contingent of Super-Spiked readers that feel otherwise).

Adding CROCI, a “cash-on-cash” corporate profitability metric, to our toolkit

In coming Super-Spiked posts, we will look to (re-)introduce a metric pioneered by the great Credit Suisse First Boston energy equity research team from the 1990s, what they called return on gross capital invested (ROGIC) and at Goldman Sachs we called cash return on gross capital invested (CROCI) (pronounced “croaky”). The essence is to complement a “book” return metric like ROCE with a “cash-on-cash” return metric like CROCI. In a nutshell CROCI uses cash flow from operation in lieu of net income in the numerator and it grosses up capital employed for accumulated DD&A (and a few other items) to move capital employed to a notion of gross capital invested (the denominator) from which cash flows are being generated.

A few summary points on ROCE vs CROCI:

- A “cash-on-cash” corporate-level returns metric has intuitive appeal as the “real” economics of any business, i.e., the generation of cash flow. It is also not impacted by accounting write-offs.

- The main reason we have heretofore emphasized ROCE over CROCI is that the former takes into account the notion of a capital charge for needed investments via DD&A. Our main knock on CROCI is that it does not explicitly reflect a capital charge.

- During our Goldman career, various attempts to address this via “free CROCI” (i.e., net of estimated maintenance CAPEX) or a similar adjustment left us feeling too dependent on manipulable assumptions. It is something we will look to take a fresh run at in the future.

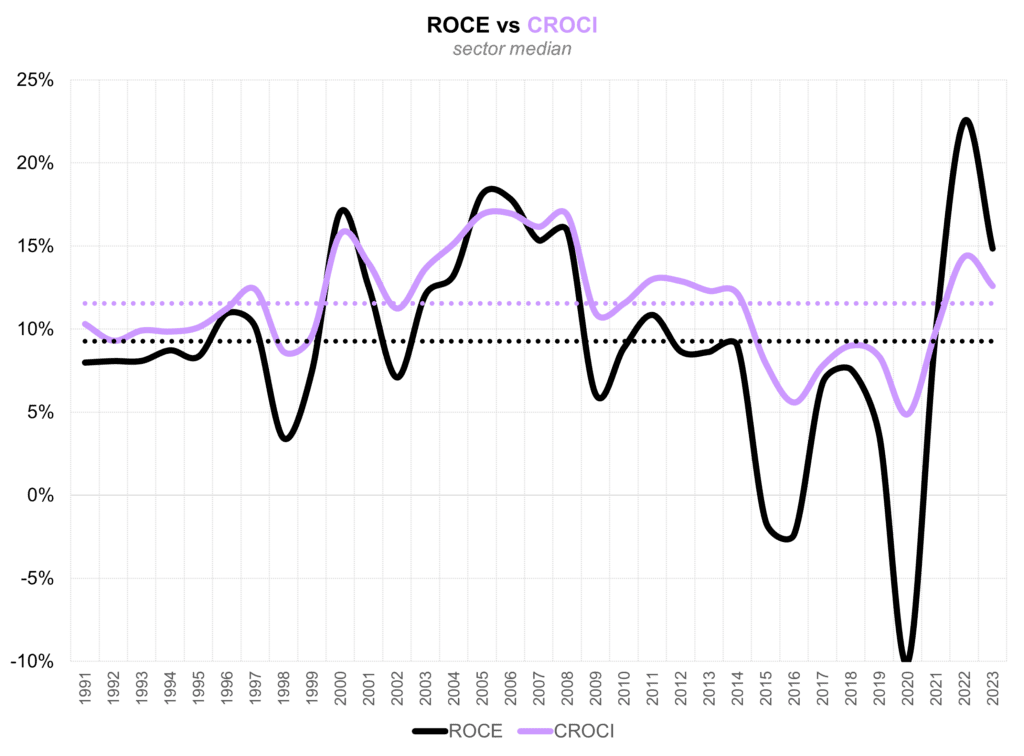

Exhibit 7 shows that CROCI follows the same long-term cycle trend as ROCE. Notably, both metrics peaked in the 2006-2008 time frame at the height of the Super-Spike era. The gap between ROCE and CROCI becomes more noticeable post the oil price crash of late 2014-2015. The impact of write-offs made the 2016 and 2020 profitability troughs considerably deeper for ROCE than CROCI. Similarly, the 2021-2022 rebound in CROCI is significant, but less pronounced than ROCE.

At the sector level, which has been the focus of Super-Spiked, there really are not meaningful conclusionary differences from using one metric over the other. Where it becomes more relevant is with sub-sector and especially company-specific analysis. In coming weeks, we will provide a more in depth look at CROCI, including definitions, an expanded discussion on the pros and cons with ROCE and other metrics, and a look at sub-sector comparisons, among other issues.

Exhibit 7: CROCI versus ROCE

Source: FactSet, Veriten.

⚡️ On a Personal Note: 55

I turned 55 over Easter Weekend. For everyone younger than 55, it’s not that bad. For everyone over 55, I appreciate your noting how young I am. A round number birthday seem like the perfect opportunity to look back at previous ages that ended in 5.

5 (1974): I remember being in Mrs. Dawson’s morning Kindergarten class. Sadly, I was too young to remember the Knicks most recent championship, which came a year earlier. Jalen Brunson has the opportunity to go down as one of the all-time greatest Knicks if he can deliver what would technically be the 3rd Knicks championship in my lifetime, though the first I would actually remember. It’s probably not happening this year given injuries to key starters, but I finally feel good about this team and Leon Rose’s oversight of the franchise.

15 (1984): I had a great high school experience, terrific friends (many of whom I am still close with), and loved playing in a metal band (Maelstrom…videos are on YouTube if you can find them). And I have previously recognized that in June 1984 I went to my all-time favorite rock concert, the pure chaos of seeing peak Judas Priest at Madison Square Garden, where they are still banned 40 years later from playing the venue due to damages MSG sustained that evening (I was merely a witness, not a vandal).

25 (1994): I was living in Denver and had just completed my second year as a junior equity research analyst at Petrie Parkman after graduating from the University of Denver with a Finance degree. My first boss and mentor, Paul Leibman, offered me the opportunity to be the lead analyst for the large-cap E&Ps, which were of less relevance to Petrie than the small-caps that were its core focus. The New York Rangers won the Stanley Cup that year and the Knicks had an exciting but crushing finals loss in 7 games to the Houston Rockets (why did Pat Riley keep letting John Starks shoot?!?!?!?). America’s Team was in the midst of their early 1990s dynasty run. Who knew then that this would be the highlight for Knicks/Rangers/Cowboys fans for the next 30 years (and counting)! Fortunately, 1994 marked a turn for the better for the Yankees, culminating in their dynastic run in the second half of the decade.

35 (2004): Between 25-35 I added a wife and 2 (of our now 3) babies to my life. It turns out that 2004 was the precursor year to a career-making Super-Spike call, with a report we published in September that set the groundwork for the big March 2005 call that is the namesake for this publication.

45 (2014): I retired as a partner at Goldman Sachs! I got to see my kids for middle and high school. Giving up a Goldman partner’s income in order to spend time with family is perhaps the best no brainer decision I have ever made in my 55 years. Full credit to my wife for sparking the move. I am richer for it.

55 (2024): I just completed year 1 of “un-retirement” with Veriten at the start of a new energy cycle and a lot of mis-understanding about why we use energy, the role of various energy sources and technologies to human progress, and the outlook for energy sub-sectors. Veriten is the fourth firm I have worked for on a full-time basis and closes the circle with my career start at the boutique investment bank Petrie Parkman. My kids are all now college-aged. No one is off the payroll, yet. Advice from older readers on how to think through that is welcomed. We did add a golden doodle to our family—yet another blessing—and are looking forward to being empty nesters.

65E (2034E): I actually don’t like the idea of a 10-year ahead forecast for myself. I always appreciated Goldman Sachs CEO Lloyd Blankfein’s recommendation at partner meetings (paraphrasing): “Stop asking what inning the current downturn is in. No one knows. Don’t wish your life away by wanting to jump ahead to recovery. Do the best job you can for Goldman’s clients today.” Wise words: live and produce for today. So I have no projections for what I’ll be doing at 65. As I sadly have become all too aware in recent years, I have to get there first and that is not guaranteed. A local friend who is a doctor told a bunch of us that as a man, if you can make it through your 50s, you will live a long life. Half way there!

Today (55): So, right now I am looking forward to watching the Yankees try to maintain their fast start to the new baseball season, hoping the Knicks can get healthy for a good playoff run, and am cautiously optimistic that the Rangers have a real chance for their first Stanley Cup since 1994. And we are on the verge of Spring golf in the northeast!

Based on this, you might like:

August 5, 2023

Obliterating Peak Oil Demand Fears As Energy Transition Realities Set In

The divergence in expected 2028-2030 oil demand between the International Energy Agency's (IEA) recently published Oil 2023 report and its May 2021 Net Zero by 2050 report is staggering.

Play now